🔹 Introduction

PM Mudra Yojana (प्रधानमंत्री मुद्रा योजना), जिसे PMMY भी कहा जाता है, Government of India की एक flagship business loan scheme है।

Is scheme ka main purpose छोटे, self-employed और micro business owners को collateral-free loan provide करना है, ताकि वे अपना नया business शुरू कर सकें या existing business को expand कर सकें।

Is article me aap jaanenge:

- PM Mudra Yojana kya hai

- Mudra loan categories

- Eligibility & documents

- Loan online apply kaise kare

- Offline application process

- Interest rate & benefits

- FAQs

PM Mudra Yojana kya hai? (PMMY Explained)

Pradhan Mantri Mudra Yojana (PMMY) ek government-backed business loan scheme hai jo non-corporate, micro aur small business owners ko ₹50,000 se ₹10,00,000 tak ka loan provide karti hai।

Yeh loan bina kisi collateral ya security ke diya jata hai.

Scheme ka objective MSME sector me self-employment aur entrepreneurship ko promote karna hai।

PM Mudra Yojana Eligibility (पात्रता)

Mudra loan apply karne ke liye applicant ko following conditions satisfy karni hoti hain:

✔ Applicant Indian citizen hona chahiye

✔ Minimum age 18 years

✔ New ya existing business owner

✔ Non-corporate business hona chahiye

✔ Business manufacturing / trading / service sector me hona chahiye

Loan Amount & Interest Rate

Loan Amount

PM Mudra Yojana ke under ₹50,000 se ₹10 lakh tak loan mil sakta hai.

Loan amount aapke business requirement aur Mudra category par depend karta hai।

Interest Rate

Mudra loan par interest rate bank decide karti hai, jo generally hota hai:

✔ 8% – 12% per annum (approx.)

Interest rate applicant profile aur bank policy ke according vary kar sakti hai.

PM Mudra Yojana Documents Required (दस्तावेज)

Mudra loan apply karte time ye documents chahiye hote hain:

✔ Aadhaar Card

✔ PAN Card

✔ Passport size photographs

✔ Business proof / Registration (agar available ho)

✔ Address proof (Aadhaar / Voter ID / Passport)

✔ Bank account details / statement (if required)

Mudra Loan Categoriwise

PM Mudra Yojana ke under 3 types ke loan diye jate hain:

| Mudra Category | Loan Amount |

| Shishu (शिशु) | ₹50,000 tak |

| Kishor (किशोर) | ₹50,001 – ₹5,00,000 |

| Tarun (तरुण) | ₹5,00,001 – ₹10,00,000 |

🔹 Category-wise Requirements

🟡 Shishu Loan (Up to ₹50,000)

- Ideal for micro business / startups

- Minimal criteria

🟢 Kishore Loan (₹50,001 to ₹5,00,000)

- Some business evidence or plan required

🔵 Tarun Loan (₹5,00,001 to ₹10,00,000)

- Stronger business plan

- Bank may evaluate turnover & repayment capacity

🟣 Tarun Plus Loan (Up to ₹20,00,000)

- Best suited for growing businesses

- Clear income/turnover and repayment projection preferred

PM Mudra Yojana Loan Online Apply Kaise Kare? (Step-by-Step)

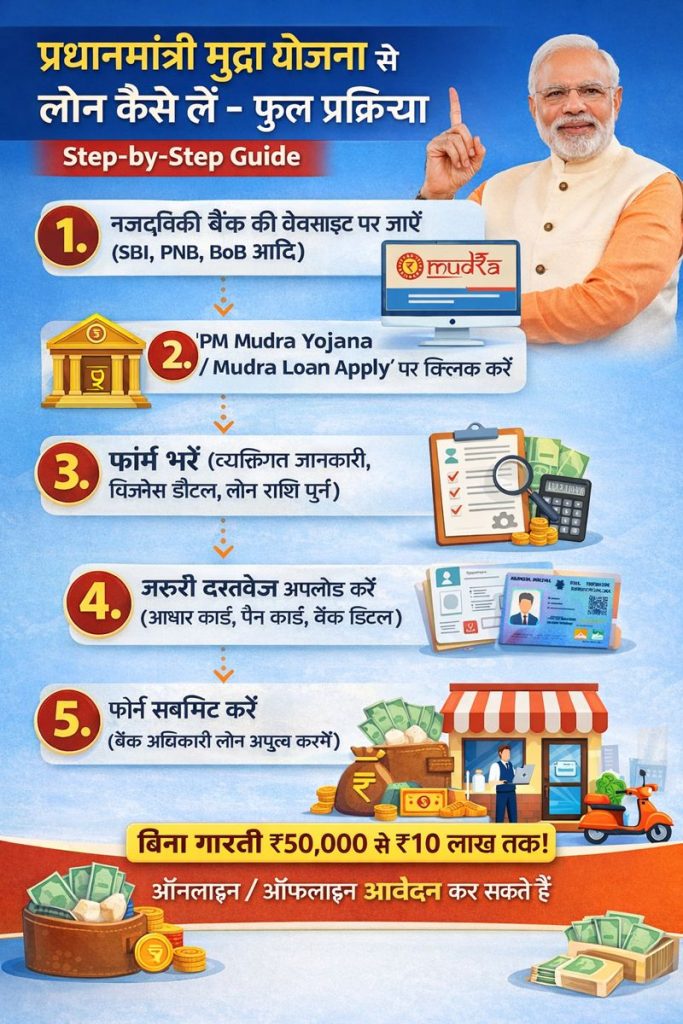

Step 1: Official Website Visit Kare

Step 2: “Apply for Mudra Loan” Option Select Kare

Step 3: Loan Category Choose Kare

Shishu / Kishor / Tarun – apni business need ke according

Step 4: Application Form Fill Kare

Personal, business aur bank details carefully bharein

Step 5: Documents Upload Kare

Required documents PDF ya image format me upload karein

Step 6: Form Submit Kare

Submit karne ke baad bank aapse verification ke liye contact karegi

✔ Kuch cases me application status online bhi track kiya ja sakta hai

PM Mudra Yojana Offline Apply Kaise Kare?

Agar aap offline apply karna chahte hain, to ye process follow karein:

- Nearest bank branch visit karein

- Mudra loan application form lein

- Required documents attach karein

- Filled form bank me submit karein

- Bank eligibility & documents verify karegi

- Approval ke baad loan amount account me transfer ho jayega

✔ Mudra loan SBI, PNB, BOI, ICICI, HDFC jaise banks se mil sakta hai

PM Mudra Yojana Benefits (लाभ)

✔ Collateral-free loan

✔ Government-backed scheme

✔ Easy loan process

✔ Small business growth support

✔ Self-employment promotion

✔ Financial inclusion badhata hai

Common Mistakes to Avoid

✔ Incomplete application form

✔ Wrong or fake information

✔ Required documents miss karna

✔ Bank follow-up na karna

FAQs – Pradhan Mantri Mudra Yojana

Q1. PM Mudra Loan maximum kitna milta hai?

👉 ₹10 lakh tak.

Q2. Kya Mudra Loan me guarantor chahiye?

👉 Generally nahi, par bank policy ke hisab se ho sakta hai.

Q3. Mudra Loan approval me kitna time lagta hai?

👉 7–15 working days (approx.)

Q4. PM Mudra Loan ka interest rate kya hai?

👉 8% – 12% (bank & profile par depend karta hai)

Q5. Kya Mudra Loan online apply free hai?

👉 Haan, application free hoti hai (bank charges alag ho sakte hain)

Final Conclusion

PM Mudra Yojana 2026 chhote business owners aur entrepreneurs ke liye ek best government loan scheme hai।

Collateral-free loan, easy application process aur flexible categories ki wajah se yeh scheme business growth ke liye bahut useful hai।

सभी का जीवन अर्जुन की तरह ही असमंजस मे है,

सब अपने हिस्से मे माधव जैसा मार्गदर्शक चाहते है..❤️🚩